Investing.com – The U.S. dollar slipped Thursday, struggling to find a foothold after weak economic data raised expectations of an outsized interest rate cut by the Federal Reserve later this month.

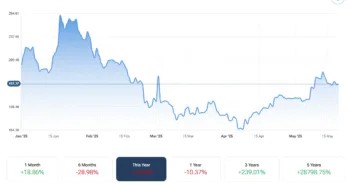

At 04:35 ET (08:35 GMT), the Dollar Index, which tracks the greenback against a basket of six other currencies, traded 0.2% lower to 101.139, continuing to retreat from the two-week high of 101.79 seen at the start of the week.

Large Fed cut coming?

The U.S. dollar has struggled for friends for most of this week after disappointing U.S. economic data raised the possibility of a hard landing for the largest economy in the world, and thus an aggressive approach from the U.S. central bank in easing monetary policy.

The ISM manufacturing survey on Tuesday showed the sector remained in contraction territory, while U.S. job openings dropped to a 3-1/2-year low in July, suggesting the labor market was losing steam.

There are weekly jobless claims and ADP private payrolls data to digest later in the session, ahead of the crucial monthly payrolls report on Friday.

Traders now see a 45% chance of the Fed lowering rates by an outsized 50 basis points when it meets later this month, and have priced in more than 100 bps worth of cuts by the end of the year.

“Unless there is a sharp downside miss to some of today’s numbers, expect DXY to trade well within a 101-102 range. But the multi-week bias is bearish,” said analysts at ING, in a note.

Euro, sterling edge higher

In Europe, EUR/USD traded 0.1% higher to 1.1086, with the single currency helped by German industrial orders unexpectedly rising in July.

German orders rose in July by 2.9% on the previous month, data showed on Thursday, a considerable improvement on the forecast fall of 1.5%.

In addition, the statistics office revised up data for June to show a 4.6% increase on the month from a previous figure of 3.9%.

Eurozone retail sales for July are due later in the session, and are expected to show a small improvement after a drop of 0.3% the prior month.

“EUR/USD has just about held support at 1.1040 this week and will probably consolidate just under 1.1100 – unless today’s US data surprises on the downside,” ING added.

GBP/USD climbed 0.1% to 1.3157, with the pair over 3.5% higher over the course of the last month, boosted by expectations that the Bank of England will keep interest rates high for longer than in the United States.

Yen close to one-month high

In Asia, USD/JPY fell 0.1% to 143.62, with the yen helped by safe-haven demand, but also on the view that imminent rate hikes from the Bank of Japan against the tide of a global easing cycle.

The yen rose to a one-month high of 143.20 earlier in the session, and for the week thus far, it is up around 1%.

USD/CNY traded 0.2% lower to 7.0999, hovering near its strongest level in over a year.