In the rapidly changing realm of cryptocurrencies, Solana is rising as one of the most promising digital assets. With its sophisticated technology and a rapidly growing community, Solana has experienced remarkable growth, establishing itself as a key player in the blockchain landscape for both innovation and practical adoption. In just the past year, the network has seen an 83% increase in its user base, outpacing Ethereum in terms of growth rate.

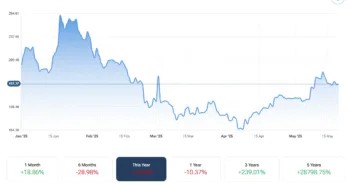

Despite not escaping the market sell-offs that began in February, which saw its price drop from over $263 to below $100, Adrian Fritz, Research Director at 21Shares, remains optimistic about Solana’s potential.

In this article:

- Statistics on Solana

- Future Outlook

Statistics on Solana

Solana is built on a high-performance infrastructure, offering low transaction fees of approximately $0.03 and the capability to handle up to 65,000 transactions per second. This has enabled it to process $364 billion in transactions during the first two months of 2025, surpassing giants like Ethereum and Coinbase and achieving nearly half of Nasdaq’s transaction volume in the same timeframe. Due to its performance, experts have dubbed it the “Nasdaq on the blockchain.”

Key innovations contributing to the efficiency of Solana’s blockchain include:

- Proof-of-History (PoH), a feature that eliminates the need for validators to approve each transaction, significantly speeding up confirmation times;

- The Turbin Protocol, which facilitates faster data processing;

- Sealevel, a system that executes smart contracts on secondary chains to prevent congestion.

This technological combination ensures that Solana excels in at least one of the three main metrics—speed, cost, and security—compared to direct competitors such as Ethereum, SUI, and TON. Major companies such as Visa, PayPal, Shopify, and Stripe have opted for Solana in developing solutions for digital payments and stablecoin management.

Future Outlook

In 2024, Solana generated $1.44 billion in net rewards and has already reached half that amount in the first half of 2025. This indicates a potential annual growth rate of 100%, positioning Solana as a cryptocurrency comparable to a stock that produces “dividends” through staking and transaction fees.

Analysts from 21Shares believe a complete “flippening” of Ethereum is unlikely in the near term; however, Solana’s growth rate of 34% above ETH suggests it is gradually capturing more market share.

If Solana could attain just 50% of Ethereum’s market capitalization, the price of the SOL token could nearly double. Naturally, this depends on Solana’s ability to sustain its growth trajectory, but the current expansion dynamics, combined with a solid and active developer ecosystem, make this scenario feasible. The year 2026 will be critical to determining Solana’s potential market share in the long run. Nonetheless, given the milestones achieved, Fritz is confident that Solana is set to play a significant role in the cryptocurrency economy.