The Recent Upsurge of the Yen: A Shift in Investor Sentiment

Over the past few days, the yen has made a comeback against the US dollar, following a brief rally triggered by the trade truce between the US and China. Investors have once again turned their attention to the yen for several reasons. Firstly, geopolitical tensions have revived the yen’s status as a safe-haven asset. While the US dollar has traditionally been seen as a safe-haven currency, investors had shied away from American assets due to the tariffs imposed by President Trump. Secondly, the Bank of Japan is open to raising interest rates once inflation stabilizes above the long-term target and the specter of deflation, which has plagued Japan for decades, is put to rest. In contrast, the Federal Reserve is expected to cut interest rates again in the near future, given concerns about rising inflation. This shift in interest rate differentials between the US and Japan favors the yen over the dollar.

The Caution of Wealthy Japanese Investors Amidst the Yen Rally

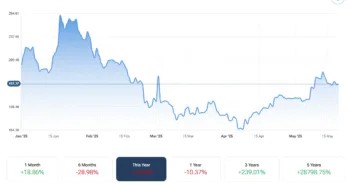

While speculators and many investors have turned bullish on the yen, affluent Japanese citizens remain cautious. Daiju Aoki, Regional Chief Investment Officer at Ubs SuMi Trust Wealth Management in Tokyo, believes that wealthy individuals in Japan are worried about the country’s economic prospects, scarred by the collapse of the market in the early 1990s following the burst of the real estate bubble from the previous decade. Aoki stated that many affluent clients harbor concerns about the yen weakening further, with USD/JPY reaching 180 or even 200 due to a weaker economy and lack of industrial investments. Currently, the USD/JPY hovers around 146, having approached 150 earlier in the week after the US-China agreement was announced. The last time the currency pair hit 200 was in 1986, shortly after the Plaza Accord led to a depreciation of the dollar against major currencies, including the yen. Following this, Japan experienced a prolonged period of depreciation, leading to a massive stimulus policy and the real estate bubble.

Wealthy Japanese individuals are apprehensive about the country’s deep demographic crisis and lagging technological innovation compared to the US and China. This skepticism has prompted some clients to gradually increase their allocation to foreign assets. Normally, affluent Japanese families hold fewer financial assets compared to their foreign counterparts. According to a report by Nomura Research Institute in December 2023, around 70% of families with assets exceeding 100 million yen own less than 500 million yen in financial assets. In contrast, globally, 57% of the wealthiest individuals hold over $5 million in financial assets. Aoki believes that the yen could weaken further as foreign investors show little interest in Japanese markets. Even when the yen plummeted to 160 per dollar last summer, it failed to attract foreign traders. Aoki emphasizes that the yen might weaken until Japanese companies repatriate or foreign entities invest in the country to bolster its infrastructure.