Bitcoin has surged to an impressive all-time high of $111,878 during the morning hours. This latest wave of optimism springs from the advancement of the stablecoin legislation in the U.S. Senate, which bolsters hopes for clearer regulations surrounding cryptocurrencies. Such developments could lead to increased institutional demand. Additionally, several other factors have contributed to Bitcoin’s recent rally.

One notable driver is MicroStrategy’s recent acquisitions, led by Michael Saylor, who has amassed over $50 billion in Bitcoin, inspiring a new wave of investors. A variety of newly established companies are financing their cryptocurrency purchases through mechanisms ranging from convertible bonds to preferred stock offerings.

An affiliate of Cantor Fitzgerald LP is partnering with stablecoin issuer Tether Holdings and SoftBank Group to launch Twenty One Capital, aiming to replicate MicroStrategy’s business model. Likewise, a subsidiary of Strive Enterprises, co-founded by Vivek Ramaswamy, is planning to merge with Nasdaq-listed Asset Entities to create a Bitcoin treasury company.

Furthermore, Bitcoin’s role as a safe haven asset is beginning to solidify amidst ongoing global uncertainty and geopolitical tensions. While some critics argue that the cryptocurrency is too volatile to replace traditional assets such as gold, the U.S. dollar, and Treasury securities, Bitcoin’s fluctuations have gradually decreased over time. There is increasing confidence that this digital currency can establish itself as a benchmark amid economic and market challenges.

Bitcoin: What is the Next Target?

Several factors reinforce Bitcoin’s current rally, suggesting that unlike past trends, this one is fundamentally distinct. Firstly, the outperformance of Bitcoin compared to smaller tokens is expanding. Secondly, the 12 spot Bitcoin ETFs have seen significant inflows, totaling $4.2 billion in May alone (Bloomberg data). The options market is also sending intriguing signals. According to reports from the derivatives exchange Deribit, this week saw the highest number of contracts for $110,000, $120,000, and $300,000 call options set to expire on June 27, marking a significant trend for the year. “This rally is not merely momentum driven; it is quantitatively supported by substantial and persistent imbalances in supply and demand,” remarked Julia Zhou, chief operating officer at crypto market maker Caladan.

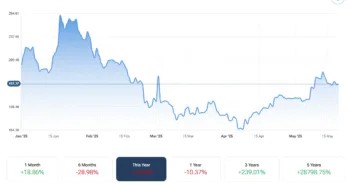

Market analyst Tony Sycamore from IG notes that “the new record indicates that the steep drop in Bitcoin from a previous peak on January 20 to below $75,000 was merely a correction within a bullish market.” He anticipates that the next bullish phase could see Bitcoin reach $125,000, contingent on a “sustained breakout above $110,000.”

Additionally, Thomas Perfumo, an economist at the cryptocurrency exchange Kraken, shares the view that the rally has room to grow. “Bitcoin’s fresh peak signals a clear indication that the current cryptocurrency bull market is far from over,” he said, citing a “virtuous cycle” stemming from stronger performance in public equity markets, inflows into ETFs, and ongoing acquisitions by corporate buyers like MicroStrategy. “As long as this trifecta of favorable conditions holds, it’s likely that dip buyers will continue to fuel the rally, as evidenced by today’s record,” he added.

Antoni Trenchev, co-founder of the digital asset trading platform Nexo, considers $150,000 to be a highly probable target. “Now that the January high has been surpassed—and a 50% increase from April lows is achieved—Bitcoin enters ‘blue sky’ territory with favorable dynamics from institutional momentum and a supportive regulatory environment in the U.S.,” he stated in an email. “We are still in the fourth year of the Bitcoin price cycle, following the halving, where miner rewards have been cut in half. Historically, this signals that the best days are yet to come. While macro uncertainties and additional volatility threats persist, a target of $150,000 by 2025 remains quite feasible,” he concluded.