Investing.com– Bitcoin’s price rose slightly on Thursday, but gains remained limited as cryptocurrency markets were pressured by a rebound in the dollar before more cues from the Federal Reserve in the coming days.

Broader risk sentiment also deteriorated as Wall Street indexes retreated from record highs, although Asian markets were much more upbeat following stimulus measures in China.

Bitcoin climbed 0.9% to $64,434.0 by 09:38 ET (13:38 GMT).

Investors still eyeing key $65k breakout level

The world’s largest cryptocurrency continues to trade below levels that traders expect to spark strong near-term gains.

A report from Coindesk said $65,000 was being pegged as a major resistance level, given that Bitcoin had not traded above the level since early-August.

The token has struggled to make any sort of price headway since hitting a record high in March, and has traded in a $50,000 to $60,000 price range for most of the year.

Market sentiment was also somewhat spooked by reports showing that a 13-year-old Bitcoin wallet, with holdings worth about $3 million, had reawakened after years of dormancy and mobilized its tokens onto an exchange.

The expiry of contracts on Bitcoin and Ether worth several billions is set for Friday, and is also expected to spur some volatility in crypto markets.

Focus is also on the potential upcoming approval of options linked to BlackRock’s iShares Bitcoin Trust (NASDAQ:IBIT) by the Securities and Exchange Commission. The approval is expected to attract more institutional capital into crypto.

Dollar rebound pressures crypto, Powell speech awaited

A rebound in the dollar pressured crypto markets, as the greenback rebounded sharply from an over one-year low on Wednesday.

Strength in the dollar came amid some uncertainty over just how much further the Federal Reserve will cut interest rates in the coming months, after a bumper 50 basis point cut last week.

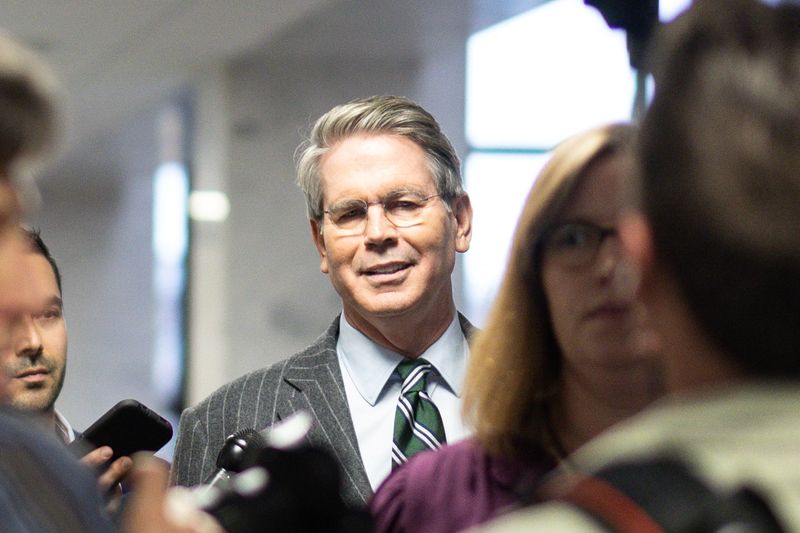

Several Fed officials said this week that they supported last week’s cut, but were uncertain over the pace of future easing. Chair Jerome Powell is set to offer more cues on that front later on Thursday.

Key U.S. economic readings are also on tap, with a revised reading on second-quarter gross domestic product data and weekly jobless claims due later on Thursday.

PCE price index data- the Fed’s preferred inflation gauge- is due on Friday.

Crypto price today: altcoins notch limited gains

Broader crypto prices were mostly higher, but like in Bitcoin, gains were largely muted.

World no.2 crypto Ether traded flat at $2,619.96, while XRP, SOL, ADA and MATIC climbed between 0% and 3.8%.

Among memecoins, DOGE jumped 5.3%.

Bitcoin ETFs see 5th day of consecutive inflows

Spot bitcoin exchange-traded funds in the U.S. recorded their fifth consecutive day of net inflows on Wednesday, amounting to $105.84 million.

BlackRock’s IBIT, the largest bitcoin ETF by net assets, saw net inflows of $184.38 million, according to data from SoSoValue. Bitwise’s BITB was the only other ETF to report inflows, bringing in $2.07 million.

On the other hand, Ark Invest and 21Shares’ ARKB experienced net outflows of $47.41 million, while Fidelity’s FBTC saw $33.19 million in outflows. The remaining eight funds, including Grayscale’s GBTC, reported no activity for the day.

Collectively, the 12 spot bitcoin ETFs had a total trading volume of $795.88 million on Wednesday, a decline from Tuesday’s $1.11 billion. Since their January debut, these ETFs have gathered a total of $17.94 billion in net inflows.

Meanwhile, spot ether ETFs also saw positive flows on Wednesday, with net inflows totaling $43.23 million. Grayscale Ethereum Mini Trust led the inflows with $26.63 million.

Ambar Warrick contributed to this report.