Investing.com — Wall Street is seen trading largely flat in holiday-impacted trade Tuesday, with Starbucks in focus as the strike affecting the coffee chain looks set to expand. The pat of future Fed rate cuts will be the key focus into 2025.

1. Fed’s rate cut path in focus in 2025

The main focus of the markets as we approach 2025 will be the path of interest rate cuts by the Federal Reserve, after the central bank policymakers detailed forecasts to cut rates by 50 basis points in 2025, bringing the target range for the funds rate down from 4.25%-4.50% to 3.75%-4.00%, citing concerns about inflation remaining above target.

Core PCE inflation, a key measure for the Fed, is projected to reach 2.5% by early 2025 if recent trends persist, above the central bank’s 2% target.

However, BCA Research expects the Federal Reserve to cut interest rates by more than 50 basis points in 2025, projecting that inflation will undershoot the Fed’s targets, while unemployment is set to rise above its forecasts.

“If monthly core PCE inflation prints at its 3-month average, the 12-month rate will hit 2.5% by March. If monthly core PCE inflation prints at its 6-month average, the 12-month rate will hit 2.5% by February,” the report notes.

This suggests inflation could align with or fall below the Fed’s forecast sooner than anticipated.

BCA said that if three consecutive PCE inflation prints average 0.2% or lower, the Fed could implement another 25 bps cut, potentially leading to total easing of up to 100 bps by the end of 2025.

BCA also noted that the labor market is losing momentum. The unemployment rate has risen to 4.2%, up from its cycle low of 3.4%, and BCA questions the Fed’s 4.3% year-end forecast.

“Hitting that level would require a significant improvement in labor market momentum, a trend shift we don’t view as particularly likely,” BCA noted.

2. Futures largely flat ahead of Xmas break

US stock futures traded largely unchanged in thin volumes Tuesday, with the market set to close early for the start of the Christmas festivities.

By 03:55 ET (08:55 GMT), the Dow futures contract was down 35 points, or 0.1%, S&P 500 futures dropped 2 points, or 0.1%, and Nasdaq 100 futures rose by 6 points, or 0.1%.

The New York Stock Exchange closes early Tuesday for Christmas Eve, and the market is also closed on Wednesday for Christmas Day.

The main Wall Street indices had started the holiday-shortened week with a positive slant on Monday, with the S&P 500 rising around 0.7%, the Nasdaq Composite closing about 1% higher and the Dow Jones Industrial Average gaining nearly 0.2%.

This follows a generally strong year, with the broad-based S&P 500 gaining over 25%, the tech-heavy Nasdaq Composite up over 30%, and the blue chip DJIA gaining around 14%.

3. Starbucks strike to expand

A strike at Starbucks’ US stores is set to expand Tuesday, with the union representing the workers at the coffee chain claiming more than 5,000 workers expected to walk off the job, with the strike expanding to over 300 stores before the five-day work stoppage ends later on Christmas Eve.

Starbucks Workers United, representing employees at 525 stores nationwide, said more than 60 US stores across 12 major cities, including New York, Los Angeles, Boston and Seattle, were shut on Monday.

Talks between Starbucks (NASDAQ:SBUX) and the union had hit an impasse with unresolved issues over wages, staffing and schedules, leading to the strike.

The Christmas Eve strike on Tuesday was projected to be the largest ever at the coffee chain, the union added.

Earlier this month, the workers’ group rejected an offer of no immediate wage hike and a guarantee of a 1.5% pay increase in future years.

4. Musk’s xAI raises $6B in new funding round

xAI, the artificial intelligence start-up founded by billionaire Elon Musk raised $6 billion in a series C funding round, which included participation from Nvidia (NASDAQ:NVDA) and AMD (NASDAQ:AMD).

The latest round puts xAI’s valuation at more than $40 billion, according to multiple reports, and comes after a series B funding round earlier this year also raised $6 billion.

xAI said the new funds will be deployed towards building more AI infrastructure and furthering the development of its flagship models.

The company aims to compete with major AI firms such as OpenAI with its Grok AI model.

Musk had founded xAI in March 2023.

5. Oil higher, but concerns remain

Crude prices edged higher Tuesday, stuck in a tight trading range ahead of the Christmas holiday period.

By 03:55 ET, the US crude futures (WTI) climbed 0.7% to $69.72 a barrel, while the Brent contract rose 0.7% to $72.81 a barrel.

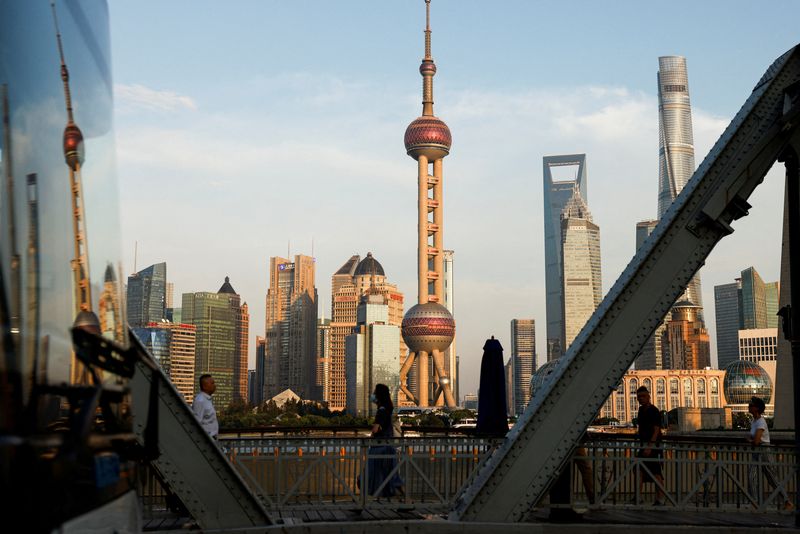

Despite these small gains, both benchmarks were down about 5% so far in 2024, with persistent concerns over slowing demand in China, the world’s largest oil importer, being a key point of pressure.

Both OPEC and the IEA have forecast slower demand growth in 2025 due to slowing demand in China. The country is also expected to face increased economic headwinds from a renewed trade war with the US under the new Donald Trump-led administration.

Oil markets were also on edge over a potential supply glut in 2025, with US oil production close to record highs, and Trump vowing to ramp up domestic energy production, as well as OPEC likely to increase production at some point in 2025.

U.S. inventory data, from the American Petroleum Institute, is due later in the session.