Investing.com — Citi analysts cautioned that U.S. equity markets “remain extended and bullish,” even after recent declines following the Federal Reserve’s more cautious stance on 2025 rate cuts.

In their latest Equity Markets Positioning Model note, Citi notes that “S&P 500 (+3.1) and Nasdaq (+4.0) futures positioning levels marginally eased but are still firmly in extended territory.”

Despite a slight uptick in short positioning last week, the analysts highlight that this shift has not significantly altered the strong bullish sentiment around these indexes.

“The overall net impact was limited,” they write, pointing to the sustained optimism in U.S. equities compared to other regions.

Meanwhile, the report flags a stark divergence in global markets. European equities are said to be increasingly bearish, with “consistent and incremental rising bearish flows” across indexes, including EuroStoxx, where positioning turned moderately bearish. Similar trends were observed in exchange-traded fund (ETF) flows, indicating waning investor confidence in the region.

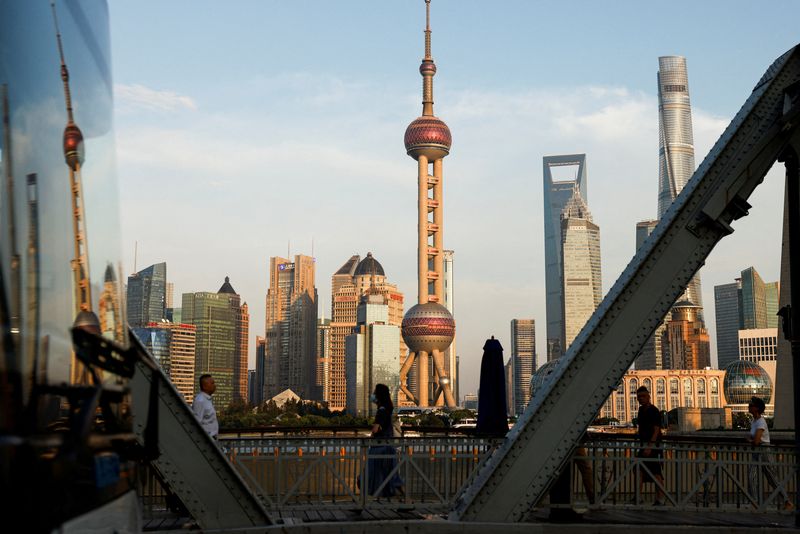

In Asia, Citi notes that positioning remains relatively neutral but with a discernible bearish shift. For China A50 and Hang Seng futures, the decline appears to be driven not only by rising short positions but also by an “unwind of longs into year-end.”

While U.S. equity markets display resilience, the analysts warn that downside risks remain for smaller-cap benchmarks like the Russell 2000, where positioning is neutral but long losses are mounting.

The report concludes that the preference for U.S. equities “appeared evident,” citing extended bearish sentiment in MSCI Developed Markets ex-U.S., where short positioning has climbed to a three-year high.