Investing.com — Gold prices fell from a more-than two-week high Thursday after stronger than US producer prices, stoked concerns about a hawkish Fed rate cut next week, boosting the dollar

At 10:20 ET (15:20 GMT), Spot gold fell 1.4% to $2,680.44 an ounce, while gold futures expiring in February fell 1.9% to $2,704.66 an ounce.

PPI data weighs

Gold weakened Thursday after US producer prices rose more than expected in November, jumping 0.4% last month after an upwardly revised 0.3% increase in October, ahead of the 0.2% gain expected.

In the 12 months through November, the PPI shot up 3.0% after increasing 2.6% in October.

The in-line consumer price index inflation data, released on Wednesday, saw traders ramp up bets that the Fed will deliver a third consecutive interest rate cut next week to support a labor market. While next week’s cut is still likely, the PPI release suggests that further cuts next year might been harder to come by, and the dollar gained as a consequence.

Resilience in the dollar has limited gold’s upside, as traders favored the greenback amid increased doubts over the long-term outlook for inflation and interest rates.

However, despite these losses, the rally in gold prices “isn’t over just yet,” according to ING.

The precious metal has enjoyed a record-breaking rally in 2024, surging 25% year-to-date driven by a combination of Federal Reserve rate cuts, increased central bank purchases, and robust safe-haven demand amid geopolitical and economic uncertainties.

Analysts at ING expect these factors to sustain upward momentum in 2025, pushing gold prices to new highs.

Other precious metals were also lower, with platinum futures down 1.1% to $940.40 an ounce, while silver futures dropped 4.3% to $31.540 an ounce.

Copper hands back gains after China stimulus cheer

Benchmark copper futures on the London Metal Exchange fell 1% to $9,086.00 a ton, while February copper futures fell 0.6% to $4.2390 a pound.

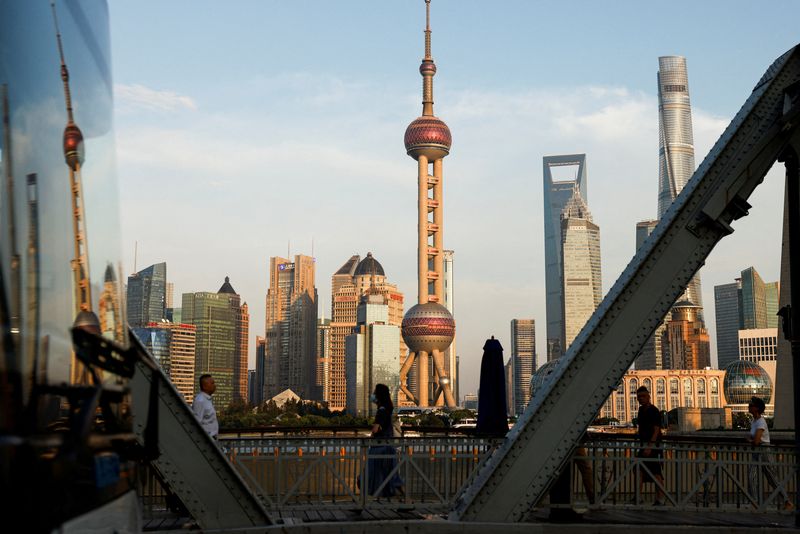

Copper has given back some of Wednesday’s gains after both contracts hit a one-month high on Wednesday amid increased optimism over more stimulus measures in top importer China.

Beijing struck its most dovish tone yet on loosening monetary policy to support economic growth, the country’s Politburo signaled after a meeting on Monday.

China’s Central Economic Work Conference- a high-level government meeting- is set to conclude later on Thursday, setting the economic agenda for 2025 and also offering more cues on plans for stimulus.

(Peter Nurse, Ambar Warrick contributed to this article.)