Investing.com — Bank of America analysts identified ten key macroeconomic themes for 2025 in a note Tuesday, predicting equity upside, policy shifts, and evolving market dynamics. Here are the highlights:

1. S&P 500 poised for gains

BofA forecasts the S&P 500 to hit 6666 by the end of 2025, driven by 13% earnings growth.

They note a record 96% of companies are expected to grow EPS by Q4 2025, signaling broad-based acceleration.

2. U.S. productivity boosts growth

Recent productivity gains are expected to enhance U.S. growth, inflation, and policy rates. However, they believe “Trumponomics 2.0” may benefit the U.S. more than the rest of the world, with unusually large risks surrounding forecasts.

3. Stable bond yields

The 10-year Treasury yield is projected to remain in a tight range of 4-4.5%, ending the year at 4.25%.

4. Commodity weakness

Oversupply and sluggish demand, especially from emerging markets (EMs), are expected to weaken commodities like oil and grains.

5. Dollar strength waning

The dollar is expected to stay strong through the first half of 2025 but could weaken later as policy and growth uncertainties rise.

6. Emerging markets face challenges and opportunities

BofA says tariff impositions could initially weigh on EMs, but a buying opportunity may arise once markets adjust, particularly if the dollar peaks.

7. U.S. cyclicals to lead

Cyclicals are said to be positioned for outperformance, supported by increased productivity, tight capacity, and favorable policy changes.

8. Credit markets gain traction

Credit issuance is expected to strengthen, with U.S. high-yield and loans favored due to robust economic performance.

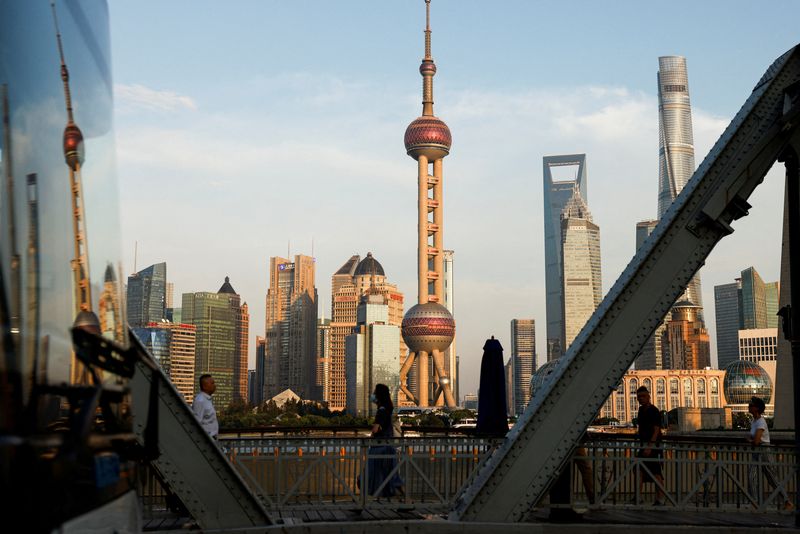

9. China’s growth slows

BofA believes real GDP growth is expected to decelerate to 4.5%, but domestic stimulus could offset tariff impacts over time.

10. EU equities volatile

The bank believes the Stoxx 600 could see a 7% dip before recovering to current levels, with a tactical overweight on European equities later in the year.