Investing.com – Global oil markets are likely to face a substantial surplus next year as Chinese demand continues to falter, according to the International Energy Agency.

“Our current balances suggest that even if the OPEC+ cuts remain in place, global supply exceeds demand by more than one million barrels (mb/d) a day,” the IEA stated in its monthly report, released earlier Thursday.

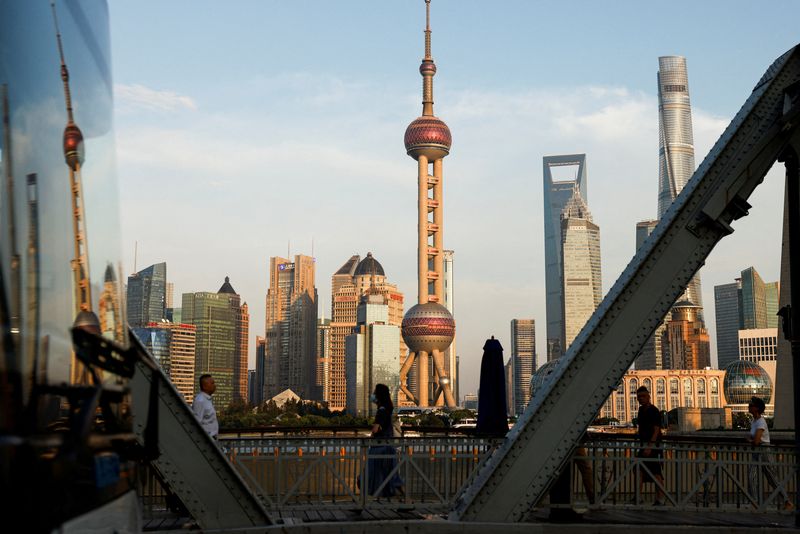

China’s marked slowdown has been the main drag on demand, the Paris-based agency said, with its growth this year expected to average just a tenth of the 1.4 mb/d increase in 2023.

Demand from the world’s largest oil importer contracted for a sixth straight month in September – taking the 3Q24 average to 270 kb/d below a year ago. By contrast, oil demand growth in advanced economies reversed course, expanding by 230 kb/d year-on-year in 3Q24.

This surplus would have been even higher if it wasn’t for the decision by the Organization of Petroleum Exporting Countries and their allies, a group known as OPEC +, to postpone a scheduled output increase at its November meeting.

The producer group, which had planned to increase output gradually starting with a modest 180 kb/d in December, announced that it would now start unwinding the extra voluntary cuts from January at the earliest.

The alliance will hold its full bi-annual ministerial meeting on Dec. 1 to review the market outlook and production policies for 2025.

On the flip side, world oil supply is rising at a healthy clip, the IEA said, and following the early November US elections, the agency continues to expect the United States to lead non-OPEC+ supply growth of 1.5 mb/d in both 2024 and 2025, along with higher output from Canada, Guyana and Argentina. Brazil is also expected to be a major source of growth next year.

“Total growth from the five American producers will more than cover expected demand growth in 2024 and 2025,” the IEA added.

Global oil prices have eased from early-October highs, as market attention once again shifted from supply risks to concerns over the health of the global economy, sluggish oil demand and ample supply.

At 08:45 ET (13:45 GMT), Brent oil futures climbed 1% to $73.03 a barrel, while West Texas Intermediate crude futures rose 1.1% to $69.19 a barrel.